Shifting the status quo for vulnerable consumers

Since 2015, Bristol’s Personal Finance Research Centre (PFRC) has been exploring the ‘poverty premium’ (when households in poverty pay more for everyday goods and services) and promoting fair treatment of vulnerable consumers across industries. To date, this work has resulted in shifts in policy and practice, especially across the financial services and energy industries. The depth of coverage from Bristol’s research team is helping a range of businesses and regulatory bodies re-shape their treatment of those in vulnerable circumstances.

Overcoming historical inequities

The University of Bristol’s School of Geographical Sciences is home to the Personal Finance Research Centre (PFRC), a diverse and highly-skilled team whose impactful research has over the last five years helped to:

- Quantify the poverty premium — Giving a clear account of how those in poverty pay more for goods and services, often because of provider processes.

- Facilitate fair treatment of vulnerable consumers — Compiling evidence-informed guidance on how financial services firms can ensure fair treatment for vulnerable customers.

Prior to PFRC’s work, investigations into the poverty premium had been speculative and sporadic. Calculations had not considered the nuanced circumstances of different vulnerable consumers, nor the specifics of services they were using. The idea of consumer vulnerability was similarly under-conceptualised and poorly understood in sectors such as financial services.

In setting out, the PFRC focused principally on participating enterprises within the financial services industry. The work has since expanded to the energy industry, and shows no signs of stopping.

Fundamentally, these two research programmes were fuelled by a simple belief: policymakers and providers have a duty to ensure all consumers are treated fairly and equally — a reality as overdue as it is vital.

Quantifying the poverty premium

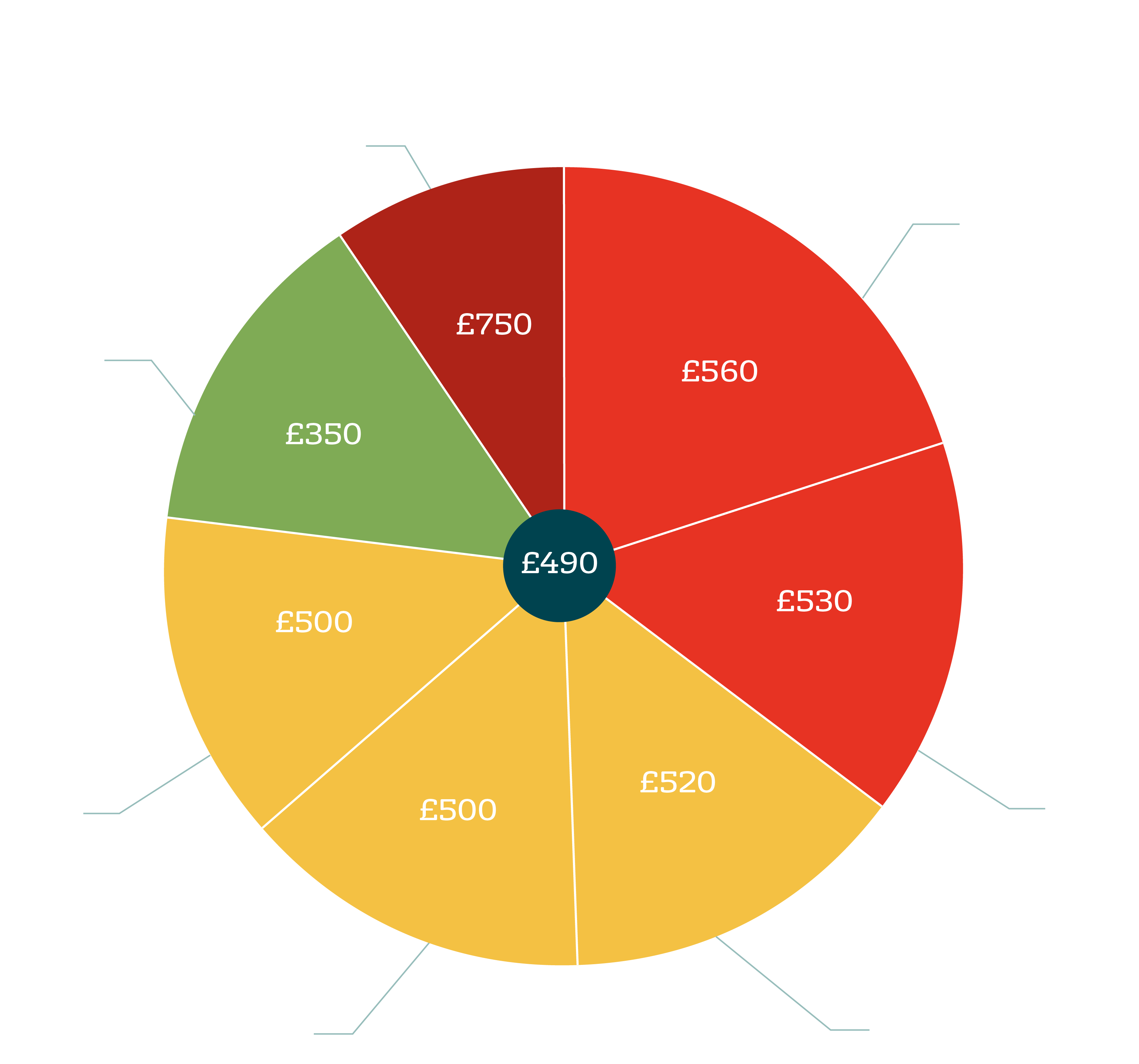

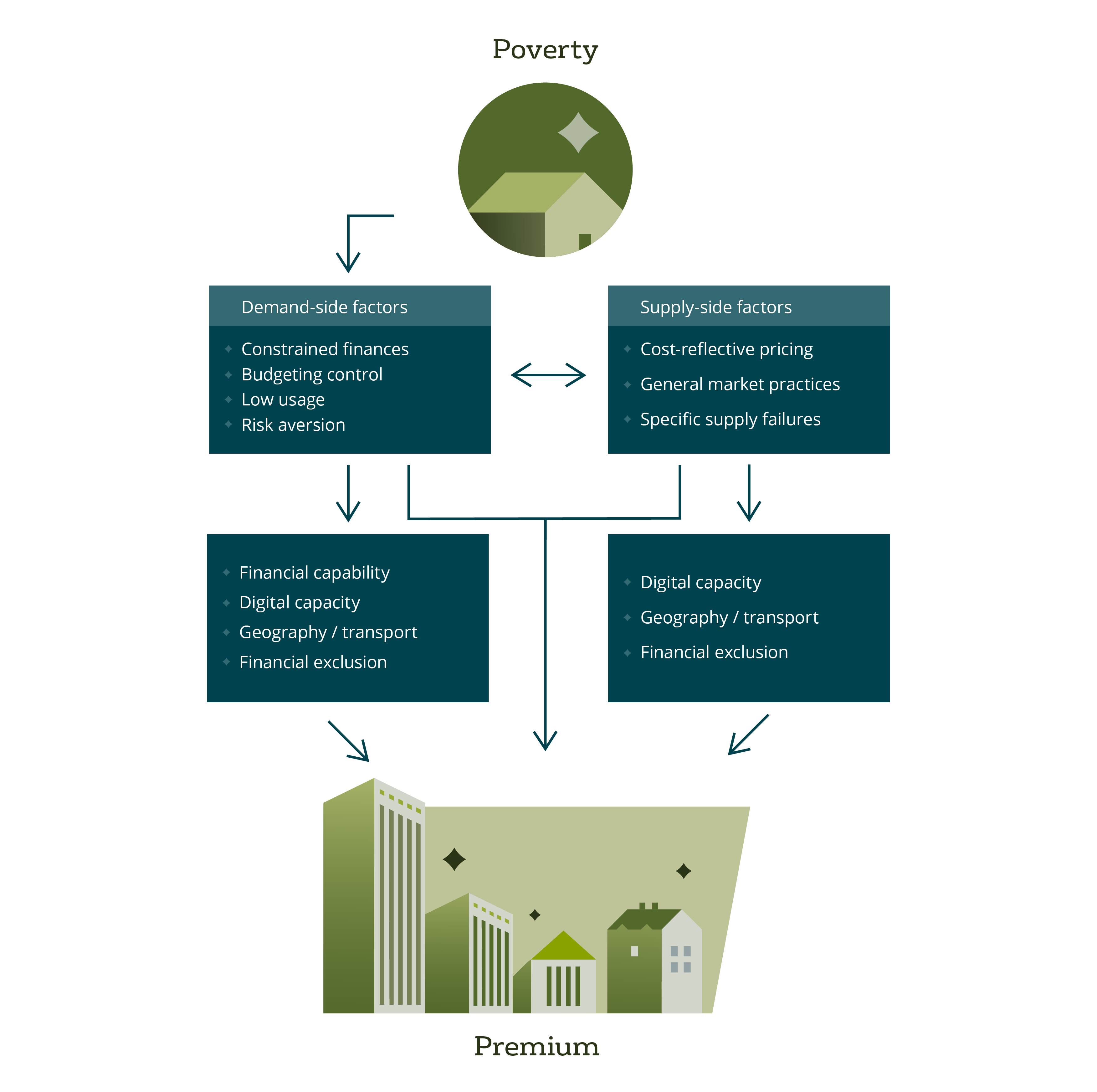

PFRC’s work on quantifying the poverty premium has focused on how those with low incomes pay disproportionately more for access to essential goods and services. The research revolved around segmentation analysis of low-income households’ exposure to hiked or inconsistent pricing when compared with higher-income households.

The research led to the 2016 research paper “Paying to be poor: Uncovering the scale and nature of the poverty premium”. It found that “low-income households pay an average of £490 more for essentials each year compared to households where money isn’t quite so tight”. For some households, however, this gulf was revealed to be far greater. Single-adult households were the hardest hit, followed by lone- parent families.

It is important to consider the impact of economic, social and cultural influences on these findings. Leading up to the 2016 paper, for example, welfare reforms had significantly impacted poorer and vulnerable customers. In the time since, these groups have faced rising inflation, the COVID-19 pandemic and the impact of Brexit on the cost of living, amongst other factors. Crises and other pivotal events will continue to cause flux in prices, but it is important that industries maintain consistent, fair service levels and avoid exploitation.

This publication helped build major impetus behind vulnerability-based research projects. In 2017, the team’s poverty premium research underpinned an ESRC-funded practical guide to demonstrate to businesses and policymakers how they could improve products and services to eliminate the stark disparity identified. These improvements can benefit the 18.9 million people in UK households below or near the poverty line.

The work also contributed to the activity and activism of several charitable organisations — for example, Citizens Advice used the Bristol methodology to calculate a poverty premium specific to mental health, and established minimum support standards from water, energy, telecoms and financial services providers.

Original data from Paying to be poor: Uncovering the scale and nature of the poverty premium (2016).

Original data from Paying to be poor: Uncovering the scale and nature of the poverty premium (2016).

Conceptual framework for understanding pathways to the poverty premium, from Paying to be poor: Uncovering the scale and nature of the poverty premium (2016)

Conceptual framework for understanding pathways to the poverty premium, from Paying to be poor: Uncovering the scale and nature of the poverty premium (2016)

Facilitating fair treatment of vulnerable consumers

The PFRC’s consumer vulnerability programme initially focused on how standardised processes within the financial industry may be detrimental to individuals with mental health issues. It became apparent that certain groups of consumers require adapted user experiences and enhanced levels of care to get the same outcomes as the non-vulnerable. This is because, in most cases, consumer protection legislation is designed around the ‘average’ consumer.

Accordingly, the scope of the research grew to encompass the full characterisation of ‘consumers in vulnerable circumstances,’ as made by the Financial Conduct Authority (FCA, conduct regulator for over 50,000 financial services firms and financial markets in the UK) - including physical health issues, emotional distress, caregiving, or bereavement. The number of vulnerable people amounts to around half of UK adults (27.7 million). It was important to understand not only how these vulnerable populations were disadvantaged in terms of service levels, but what nuances there were in the treatment of different groups of customers, and how good practice could better support these customers.

The team ran surveys, interviews and discussion groups with frontline staff working in consumer lending and debt collection, facilitated by trade bodies such as the Finance and Leasing Association, the Building Societies Association, and members of what is now UK Finance. This mediation gave PFRC access to a range of firms that may have otherwise been reluctant to participate. The resulting statistical analysis formed a novel and unique evidence base, which has since sent waves of reform across several sectors in the form of practical tools and guidance.

The energy body Energy UK recognised the applicability of the research findings for its own members, leading to the publication of a guide on vulnerability, mental health and the energy sector. The materials were also taken up in large-scale initiatives such as the Money Advice Trust’s vulnerability training and UK Finance’s Vulnerability Academy, led by PFRC Honorary Research Fellow Chris Fitch.

PFRC research has directly improved policy and practice, in turn improving outcomes for vulnerable consumers. Research-informed protocols—developed by PFRC to help customer-facing staff support vulnerable consumers—have been endorsed and promoted by major UK trade bodies, and adopted by lenders and debt advisers across the UK.

Eliminating the poverty premium

Sara Davies, who led the poverty premium programme, is proud that the PFRC’s findings have “resulted in a £10m social investment firm being set up”. She refers to the Fair by Design Fund (FbD), an initiative launched by the Joseph Rowntree Foundation and Big Society Capital which is striving to eliminate the poverty premium in the UK by 2027.

FbD’s funds are invested across four areas identified by the research — energy, finance, insurance and geography-based premiums. As of 2020, FbD had invested in eleven ventures to tackle the premium.

An ongoing corollary of the research is FbD’s collaboration with the Global Open Finance Centre of Excellence, who are striving to use data to answer social questions, including whether transaction data can create a temporal index of the poverty premium. The PFRC findings have also been used in campaigns and publications by the Centre for Social Justice, Social Market Foundation, End Child Poverty and National Energy Action.

From top left to bottom right: Jamie Evans; Senior Research Associate, Sara Davies, Senior Research Fellow, Andrea Finney; Honorary Senior Research Fellow, Professor Sharon Collard; Chair in Personal Finance, Chris Fitch; Honorary Research Fellow

From top left to bottom right: Jamie Evans; Senior Research Associate, Sara Davies, Senior Research Fellow, Andrea Finney; Honorary Senior Research Fellow, Professor Sharon Collard; Chair in Personal Finance, Chris Fitch; Honorary Research Fellow

About PFRC: putting consumers first

The PFRC is an independent research centre specialising in social research across all areas of personal finance, and especially from the consumer’s perspective. Since its inception in 1998, researchers at PFRC have consistently designed surveys, analysed data and reviewed existing structures to amass a credible, impactful body of work. Their research has scope to impact on a nationwide level, as well as across global industries.

The centre’s poverty premium and consumer vulnerability research programmes were borne from an awareness that structural disparities lock consumers in cycles of poverty and unfair treatment. They have evolved to maintain PFRC’s strong record of influencing and informing policy.

What’s next?

The PFRC is a small team driving big impacts. By collaborating with industry partners and trade bodies, the team continue to produce research that is increasingly difficult to ignore.

Dissemination and coverage of research findings have been key. For example, national news outlets pointed to the pertinence of the poverty premium research back in 2017. All firms that participated in the consumer vulnerability analysis received a bespoke report benchmarking their performance against the national average — the kind of transparent feedback that could well be key to heightening exposure and ensuring firms pay more attention to their operational shortfalls.

There’s no escaping the fact that change needs to come from the top and as such, the involvement of regulators within the financial services and energy industries will be key for future work. The PFRC’s consumer vulnerability activity has helped influence the FCA, who in February 2021, published new, thorough guidance for treatment of consumers in vulnerable situations, drawing on the PFRC’s work.

The team continues to collaborate with the Global Open Finance Centre of Excellence and Fair by Design to further fine-tune their understanding of the poverty premium, regularly publishing additional advice on how to reduce its hold and continuing to gain national media attention. Likewise, their work on consumer vulnerability has expanded in scope, to include a programme of research exploring gambling-related harms and vulnerability, including the links between problem debt and gambling and women’s experiences of gambling and gambling harm.